Excepted risk

Insurance provides third-party protection against risks. Risks on construction projects can be significant, and so insurance is very common, providing protection both for the insured, and for the party to whom the insured has a liability.

Many standard forms of construction contract include a requirement for insurance to be taken out by the parties to the contract. Policies may be taken out by the contractor or by the client depending on the form of contract and the options selected, but they will generally be in the form of a ‘joint names policy’ in the names of both the contractor and the client. This gives both parties their own rights to claim against the insurer. Other parties, such as funders may also be added as a joint name.

Insurance policies may cover all risks, or may be restricted to certain ‘specified perils.’ However, in either case, there may be ‘excepted risks’, for which insurance is not required (because it will usually be unobtainable).

Excepted risks might include:

- The use or occupation of the works by the employer, its agents, servants or contractors.

- Any fault, defect, error or omission in the design of the works (other than design provided by the contractor).

- Riot, war, invasion, act of foreign enemies or hostilities.

- Civil war, rebellion, revolution, insurrection or military or usurped power (not including terrorism).

- Radiation or contamination by radioactivity.

- Pressure waves caused by aircraft or other aerial devices travelling at sonic or supersonic speeds.

The cost of rectifying damage caused by such risks is generally borne by the employer, although there is usually provision for the apportionment of rectification costs where the cause is contributed to by both an excepted risk and one for which the contractor is responsible.

[edit] Related articles on Designing Buildings Wiki:

- Alternative Dispute Resolution legislation.

- Compensation event.

- Contract conditions.

- Cost reimbursable contract.

- Defect.

- Insurance.

- Joint names policy.

- Misrepresentation and insurance.

- Specified perils in construction contracts.

[edit] External references

- ‘Construction Insurance and UK Construction Contracts’ (2nd ed.), LEVINE, M., TER HAAR, R., Informa Law (2008)

Featured articles and news

Wellbeing in Buildings TG 10/2025

BSRIA topic guide updates.

With brief background and WELL v2™.

From studies, to books to a new project, with founder Emma Walshaw.

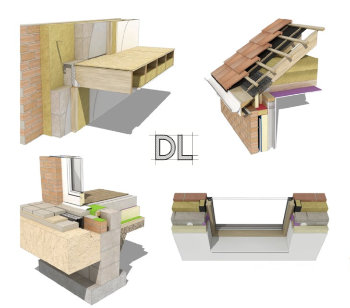

Types of drawings for building design

Still one of the most popular articles the A-Z of drawings.

Who, or What Does the Building Safety Act Apply To?

From compliance to competence in brief.

The remarkable story of a Highland architect.

Commissioning Responsibilities Framework BG 88/2025

BSRIA guidance on establishing clear roles and responsibilities for commissioning tasks.

An architectural movement to love or hate.

Don’t take British stone for granted

It won’t survive on supplying the heritage sector alone.

The Constructing Excellence Value Toolkit

Driving value-based decision making in construction.

Meet CIOB event in Northern Ireland

Inspiring the next generation of construction talent.

Reasons for using MVHR systems

6 reasons for a whole-house approach to ventilation.

Supplementary Planning Documents, a reminder

As used by the City of London to introduce a Retrofit first policy.

The what, how, why and when of deposit return schemes

Circular economy steps for plastic bottles and cans in England and Northern Ireland draws.

Join forces and share Building Safety knowledge in 2025

Why and how to contribute to the Building Safety Wiki.

Reporting on Payment Practices and Performance Regs

Approved amendment coming into effect 1 March 2025.